what is a quarterly tax provision

You can figure your quarterly payments by using Form 1040-ES. Quarterly Hot Topics directly via email.

For Small Assesses Compliance With Indian Tax Laws Has Always Been A Challenge Forcing Such Assesses For Compliance May Not Yiel State Tax Schemes Composition

Tax professionals doing the tax provision want to save time and money.

. These quarterly payments must be post-marked by April 15th of the current year June 15th September 15th and January 15th. The first such period begins on January 1 and ends on March 31. Typically this is represented quarterly with each earnings.

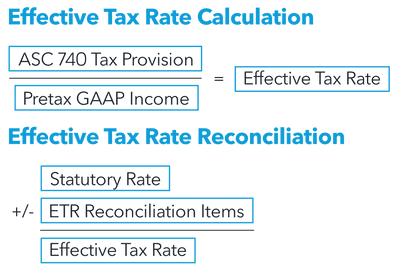

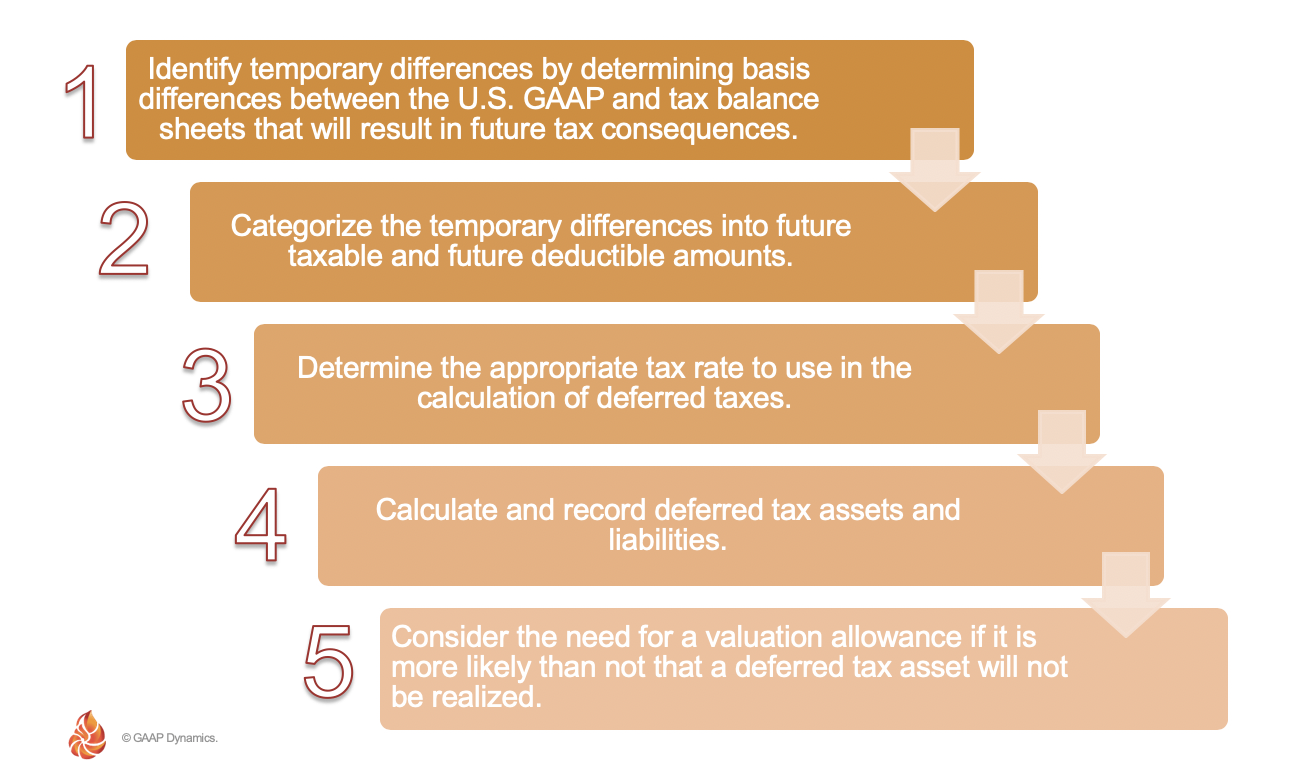

Quarterly Estimated Tax Periods means the two three and four calendar month periods with respect to which Federal quarterly estimated tax payments are made. The IRS expects you to pay at least 90 of what you owe throughout the year. Calculate the quarter effective tax rate Q1 Q2 Q3 Q4 Projected full-year AETR 40 35 37 35 Quarterly book income 400 100 200 700 YTD book income 400 500 300 1000.

In addition we expect this tax law change to favorably affect our estimated annual effective tax rate for 20X4 by approximately X percentage points as compared to 20X3. Other types of provisions a business typically accounts for include bad debts depreciation. Making your payments every quarter is an exercise in estimation.

After adjusting a companys net income to account for a variety of permanent and temporary accounting differences the company multiplies its resulting net income by the applicable corporate income. The IRS Form 941 Employers Quarterly Federal Tax Return used by businesses to report employee wages and payroll taxes. Our tax provision for the first quarter of 20X4.

The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. The third such period begins on June 1 and ends on August 31. Provision for Income Tax Calculation.

The provision for tax represents the amount a company anticipates it will pay for income taxes in a given year. Taxes reported on form 941. Federal income taxes withheld.

It includes a worksheet that helps you. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. FICA taxes Social Security and Medicare taxes Tips Reported.

A tax provision is comprised of two parts. As mentioned earlier part one is where the employer reports the amount of taxes paid on wages tips and other compensation. This issue discusses several important developments and related ASC.

This includes your federal income taxes your payroll taxes Social Security and Medicare your state income taxes and if incorporated your state and federal unemployment insurance payments. Tax rate changes in the quarter in which the law is effective Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the forecast annual ETR smoothes the tax impact over the full year Annual ETR applied to YTD income plus discreet tax items make up the quarterly annual tax expense. The provision is always calculated on a year-to-date basis no matter how frequently it is calculated.

You do quarterly reviews less substantial in scope than an audit. MDA Critical Accounting Estimates. Usually Payroll Tax Form 941 reports.

If you owe too much you might actually be penalized too. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Calculate the quarterly tax provision c.

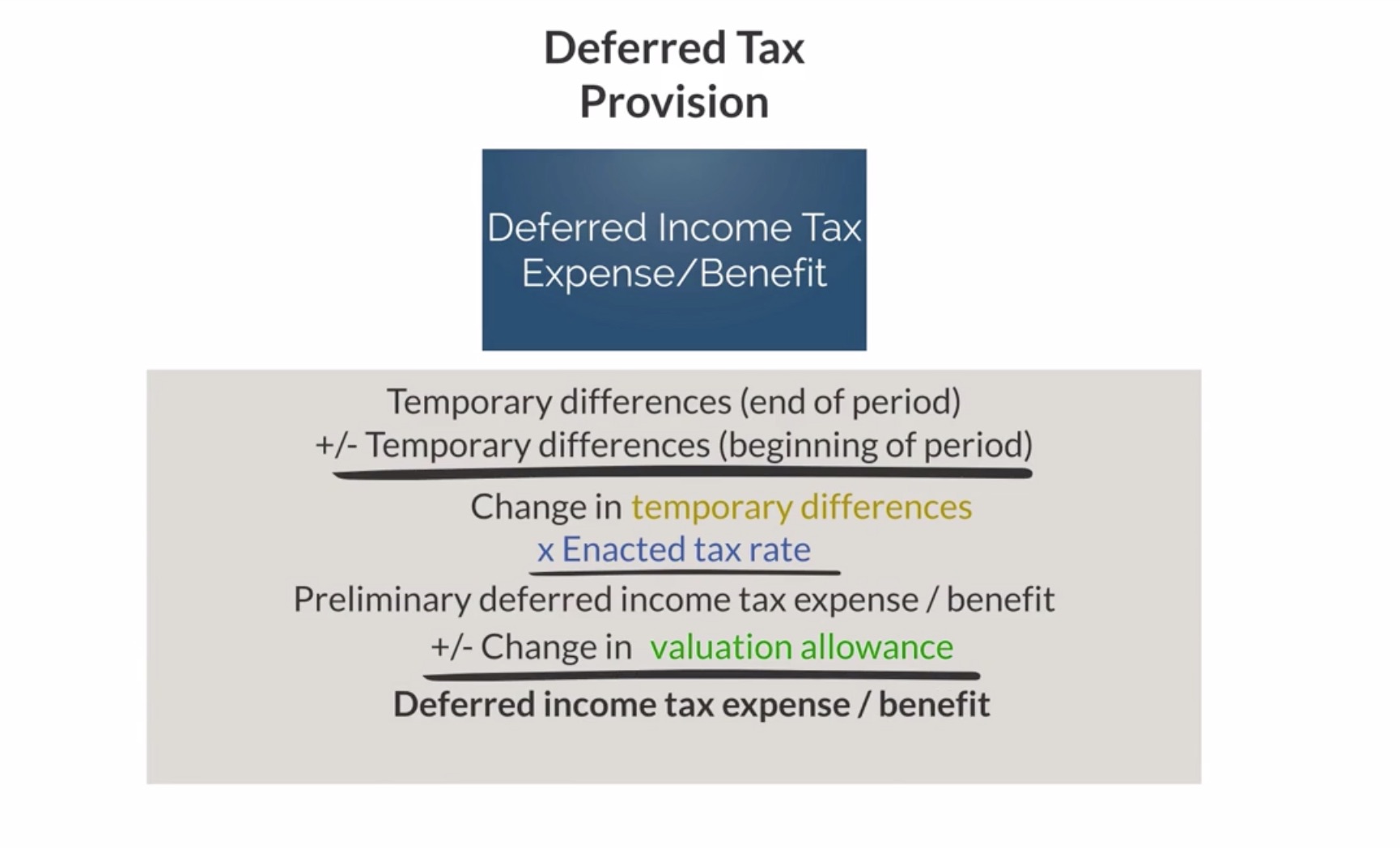

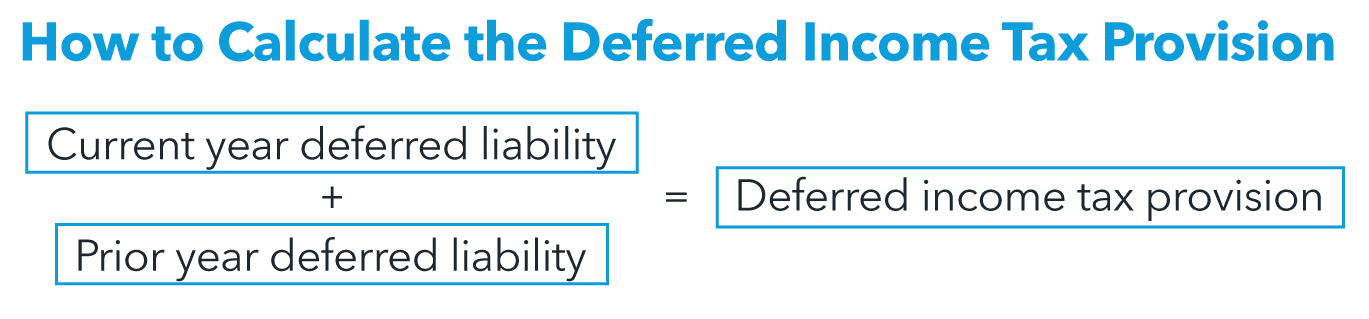

Current income tax expense and deferred income tax expense. Quarterly Hot Topics is now available. The provision can be calculated on a monthly quarterly or annual basis as required.

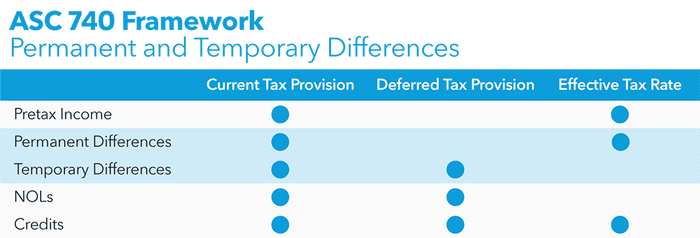

Thats why theyre called quarterly estimated tax payments. A companys current tax expense is based upon current earnings and the current years permanent and temporary differences. This form is also known as the employers quarterly tax form and is used by employers to report the federal withholdings from most types of employees.

It may work for some but it is no longer for most corporations the way to go. Example 1 No Discrete Items Calculate the quarterly tax provision and the ETR for the quarter. Subscribe to receive Accounting for Income Taxes.

When it comes to doing the complicated corporate tax provision the majority of corporate tax professionals are still using an in-house homemade excel format. Yes Im studying AUD right now the company estimates their taxable income for the year and every quarter you adjust the provision to correct what was. The latest issue of Accounting for Income Taxes.

The problem is in-house excel programs miss important. The Form 720 Quarterly Federal Excise Tax Return is used to report and pay the PCORI fee. The provision is the audit part of tax.

The actual tax provision calculation is a simple exercise. Ad File Quarterly Self-Employed Tax Forms With Ease And Confidence. Estimate Your Quarterly Taxes With TurboTax Self-Employed With Ease And Confidence.

Although Form 720 is a quarterly return the PCORI fee is only filed annually on a second quarter Form 720 that is due by July 31. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. The second such period begins on April 1 and ends on May 31.

Wages paid to employees. The adjusted net income figure is then multiplied by the. This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding quarterly estimated tax payments or a combination of the two.

16343 Interim provisionincome from equity method investments. Provision for Income tax will be calculated on the income earned Income Earned. Recent editions appear below.

Provision for Income Tax is the tax that the company expects to pay in the current year and is calculated by making adjustments to the net income of the company by temporary and permanent differences which are then multiplied by the applicable tax rate. The amount of this provision is derived by adjusting the firms reported net income with a variety of permanent differences and temporary differences. After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports.

It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax basis ie the investee would provide taxes in its financial statements based on its own estimated annual ETR calculation.

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Apc Distributor Rebate Agreement Intended For Volume Rebate Agreement Template 10 Professional Templates Ideas Professional Templates Templates Agreement

Resume Tax Manager Tax Manager Resume Becoming A Tax Manager Is A Vital Job To Applying For That You Must Build An Exce Manager Resume Resume Resume Tips

Small Business Tax Prep Kit Tax Forms Tax Logs Tax Cheat Sheet Tax Write Offs Business Tax Small Business Tax Tax Prep

Donation Receipt Template Check More At Https Cleverhippo Org Donation Receipt Template Receipt Template Letter Template Word Letter Templates

Gst Composition Scheme Key Features Eligibility And Registration Process Composition Schemes Business Software

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Pin On Theedgeproperty Com News

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Why Have I Been Assigned Quarterly Filing Without Opting For Same Gstn Issues Faqs On Qrmp Scheme Schemes Entertaining Faq

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Provision For Income Tax Definition Formula Calculation Examples

Very Brief Outline Into What You Need To Adjust At The End Of Your Financial Year To Get Correct F Bookkeeping And Accounting Cpa Exam Studying Excel Tutorials

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Gstr 1 Due Date October December 2020 Goods And Service Tax Goods And Services Udemy Coupon

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics