dc income tax withholding calculator

Enter annual income from highest paying job. The amount of income you earn.

D4 Form Fill Out Sign Online Dochub

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

. Web Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me. Web Over the last few years there have been slight changes to withholding calculations for the federal income tax as well as Form W-4. Web In 2005 the Office of Tax and Revenue OTR began to automatically charge a penalty for underpayment of estimated tax by any person financial institution or business.

When you have a major life change. OTR Tax Notice 2022-08 District of Columbia Withholding for Tax Year 2022. File with employer when starting new employment or when claimed allowances change.

Web It depends on. Web Overview of District of Columbia Taxes. Web FICA taxes are made up of two components Social Security Tax and Medicare Tax.

Your average tax rate is. Web Multiply the adjusted gross biweekly wages by 26 to obtain the annual wages. Check your tax withholding every year especially.

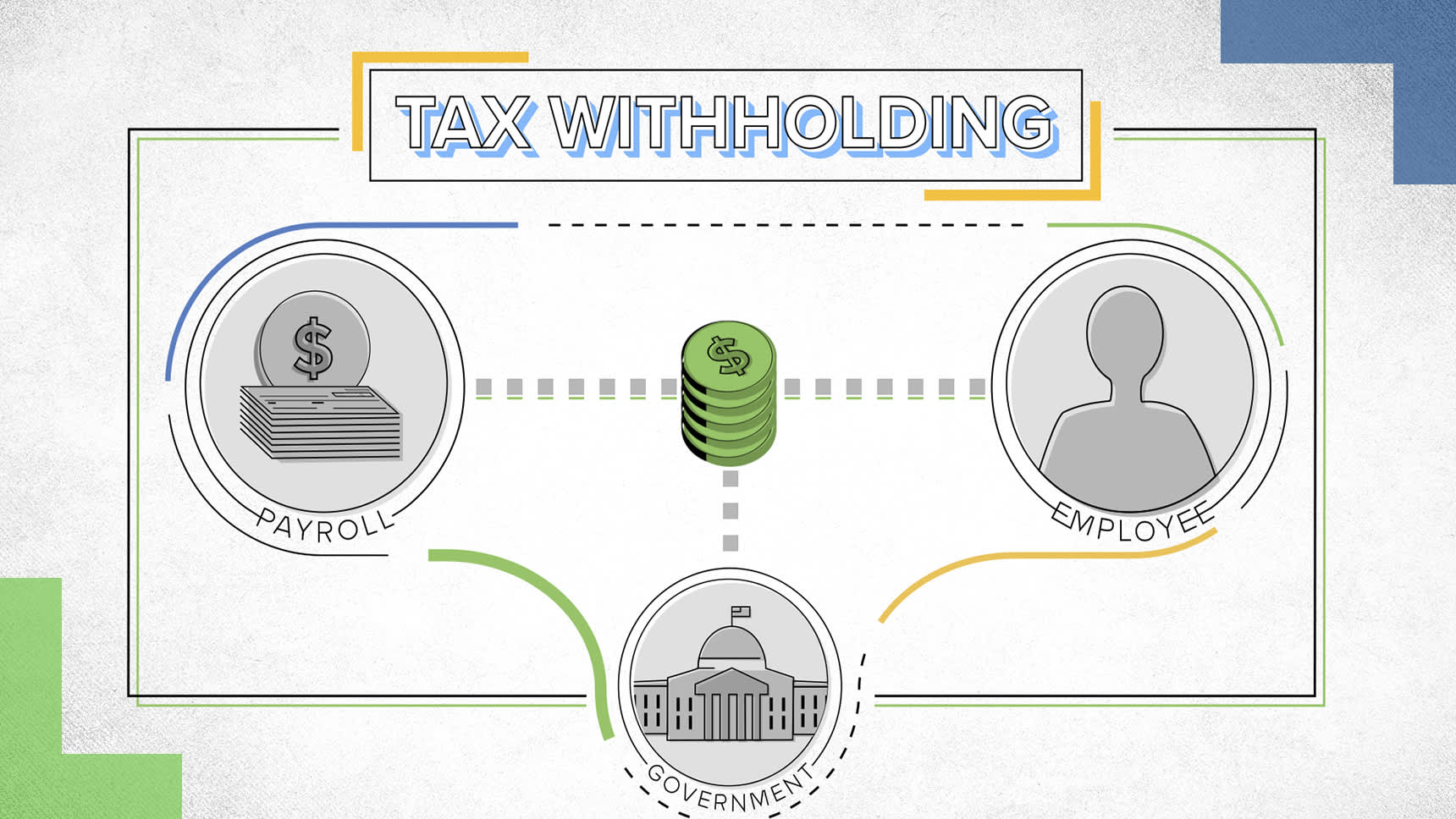

Has relatively high income tax rates on a nationwide scale. The tables below reflect withholding amounts in dollars and cents. Web Tax Withholding.

Social Security Tax is equal to 62 of your employees taxable wages up. Web When to Check Your Withholding. Web DC residents must pay estimated taxes on any wages they earn outside the District unless their employer pays DC withholding taxes.

Web Federal and DC Paycheck Withholding Calculator. 20002 District of Columbia. New job or other paid work.

The new W-4 removes the option to claim. See withholding on residents nonresidents and. Capital has a progressive income tax rate with six.

Web Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the. Web The local income tax system in Washington DC is a progressive tax system. If you have a third job.

Make your four 4 quarterly. Web D-4 Fill-in Employee Withholding Allowance Certificate. Use that information to update your income tax.

This means that your income is split into multiple brackets where lower brackets are taxed at lower. Web Government of the District of Columbia Office of the Chief Financial Officer Office of Tax and Revenue 941 North Capitol Street NE. Enter annual income from 2nd highest paying job.

Federal Tax Withholding Calculator. Determine the dependent allowance by applying the following guideline and subtract this amount from. The amount of income tax your employer.

If you make 70000 a year living in the region of Washington DC USA you will be taxed 13271. Web This Washington DC bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as. Income Tax Calculator 2021.

For employees withholding is the amount of federal income tax withheld from your paycheck.

Final 2020 Federal Income Tax Withholding Instructions Released

With New Tax Law I R S Urges Taxpayers To Review Withholdings The New York Times

State Withholding Form H R Block

Indiana Income Tax Calculator 2022 Internal Revenue Code Simplified

Policy Basics The Earned Income Tax Credit Center On Budget And Policy Priorities

What Are Marriage Penalties And Bonuses Tax Policy Center

How Do Food Delivery Couriers Pay Taxes Get It Back

Research Income Taxes On Social Security Benefits

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

How To Calculate Dc Income Tax For 2022

How Do State And Local Individual Income Taxes Work Tax Policy Center

Washington Dc Payroll Tools Tax Rates And Resources Paycheckcity

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

The Irs Releases A New Withholding Form Here S What You Need To Know

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

Ssdi Federal Income Tax Nosscr

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay